Sign up to receive quotes

Unlocking New Possibilities: VR Solutions for the Financial and Banking Sector

Table of content

In the dynamic race of technology and digital transformation, the financial and banking sector is actively embracing virtual reality (VR) technology to redefine customer experiences. This emerging trend is rapidly gaining traction among researchers and industry leaders worldwide. According to studies, 90% of Vietnamese consumers express strong interest in virtual banking services, highlighting a clear demand for modern alternatives to traditional in-person interactions.

A recent report by Visa shows that out of every 5 Vietnamese users, four are already familiar with the concept of VR and AR applications for shopping and financial transactions, and three out of ten have experienced these technologies firsthand. While the integration of VR into banking services is still in its early stages, consumers increasingly recognize it as an essential component of the future banking experience.

According to a general survey, the financial and banking sector remains one of the most fiercely competitive industries. Customers today make decisions based on a comprehensive assessment of technological innovation, information security, and the quality of customer service. To meet the rising expectations of modern users, financial institutions must adopt breakthrough digital solutions, not only to enhance brand image but also to drive operational excellence and competitive advantage.

Moreover, financial products and services are often complex, creating psychological barriers for customers unless they receive direct and detailed consultations. This traditional process lengthens the customer journey, affecting satisfaction and operational productivity.

Virtual reality (VR) and augmented reality (AR) technologies are opening a new era for the financial sector, offering immersive, interactive experiences not only for customers but also for internal training and operations. Many leading institutions around the world have pioneered VR applications, creating virtual banking environments that allow users to transact and experience services as if they were physically present.

Explore outstanding VR360 projects in the financial and banking sector: Our Project: Finance - Banking - Insurance

For example, BNP Paribas introduced a VR application enabling retail customers to visualize account activities and transaction histories in a fully immersive environment. Meanwhile, a major state-owned Chinese bank launched an automated branch featuring facial recognition, VR rooms, 3D cameras, interactive robots, and touchscreens for streamlined service delivery.

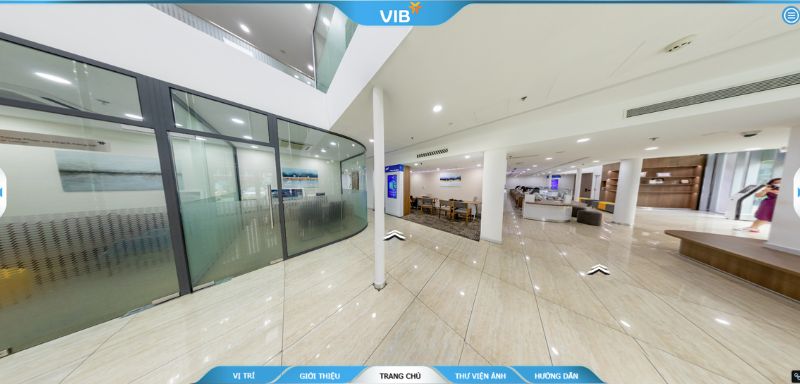

In Vietnam, Vietnam International Bank (VIB) was a pioneer with MyVIB – the first digital banking app to integrate AR technology, offering users innovative features via the "Virtual Reality" function. Similarly, PVcomBank introduced "Pivi Verse," a virtual ecosystem that consolidates banking information and services, helping customers access resources quickly, securely, and efficiently.

So,

Why are banks racing to integrate virtual reality technology into their operations? Discover the details below!

Benefits of Applying Virtual Reality in the Financial and Banking Sector

One of the most prominent advantages of virtual reality technology is the ability to elevate the user experience through realistic and immersive interactions. This empowers customers to access information conveniently, quickly, and with complete transparency.

Time Efficiency

In traditional banking services, customers often prefer visiting bank counters to interact directly with representatives to ensure information accuracy and transaction security. However, this method is often time-consuming and limits overall workflow efficiency.

By adopting virtual reality technology, customers can directly and securely access necessary information anytime, anywhere, significantly shortening transaction times without needing to physically visit the bank. From a business perspective, service teams can reduce the consultation time during the customer service journey, improving overall operational efficiency.

Realistic and Engaging Interactive Experience

Virtual reality transforms online banking transactions into dynamic, authentic experiences. Customers can navigate through the bank’s virtual environment, interact with various touchpoints, and explore service details from multiple angles — creating a proactive, visual, and lifelike information-gathering journey.

Seamless Information Integration with Multiple Features

The VR360 Tour platform enables the seamless display of product benefits, service portfolios, contact information, and real-time consultation support within a single virtual environment. This ensures customers access transparent and accurate data, connect instantly with advisors, and even initiate transactions — all during their virtual visit.

Enhancing Customer Experience

Integrating virtual reality into banking operations introduces a modern, innovative channel for customer interaction. By enabling quick and efficient resolution of queries, VR enhances customer satisfaction and significantly elevates the overall banking experience.

Creating Differentiation and Enhancing Brand Reputation

In today's fiercely competitive market, where business challenges continue to intensify, the application of virtual reality technology has emerged as a key tool for businesses to create differentiation. VR not only enhances the customer journey but also transforms online interactions with a wide range of banking products and services.

This approach also contributes significantly to improving business performance by optimizing the customer service process. With VR integration, bank representatives no longer have to spend extensive time explaining or guiding customers — instead, customers can explore detailed information through an intuitive and dynamic virtual tour. As a result, promoting products and services via VR360 tours becomes a vital strategy for building strong brand credibility and standing out in the marketplace.

PIVIVERSE - PVComBank

VR360 Services Suitable for the Financial and Banking Sector

VR360 offers a comprehensive suite of services perfectly tailored for the financial and banking sector, including VR360 Virtual Tour, 360-degree Photography, and 360-degree Video Recording.

VR360 Virtual Tour

The Virtual Tour provides an immersive experience inside the banking space, allowing customers to interactively explore services, facilities, and areas with high authenticity and vivid detail. This innovative approach leaves a strong, positive impression and effectively attracts new customers while opening doors to new business opportunities.

For more details, visit: VR360 Virtual Tour - Web 360 - 360 Tour - Virtual Map

360-Degree Photography

Our 360-degree photography service delivers multi-dimensional visualizations that vividly capture the bank’s atmosphere, far surpassing traditional 2D photography. These images are seamlessly compatible across multiple platforms like Facebook, websites, and Google Street View, helping to boost brand visibility, engage customers, and enhance corporate reputation.

For more details, visit: 360-Degree Photography Service

360-Degree Video Recording

Using state-of-the-art equipment, VR360 produces panoramic, multi-dimensional videos that showcase the bank’s facilities in stunning clarity and vividness. These videos serve as powerful promotional tools and are highly shareable across social media platforms like Facebook and YouTube, maximizing outreach and brand influence.

For more details, visit: 360-Degree Video Service

Advanced Features

The VR360 platform supports advanced functionalities such as virtual MCs, voice narration, and integrated mini-games, transforming the virtual tour experience into an engaging, interactive journey. Customers can conveniently access information without needing assistance from bank representatives.

Information Management System

Virtual reality applications for finance and banking also come with data collection and storage capabilities, providing a comprehensive management system that tracks customer information, product details, reports, statistics, and more — ensuring streamlined and efficient operations.

Multi-Language Display

VR360 enables seamless multilingual support through interfaces and narrations, allowing financial institutions to reach both domestic and international customers effortlessly.

Multi-Device Compatibility

All VR360 services are optimized for compatibility with computers, tablets, smartphones, and VR headsets — ensuring users can enjoy the experience anytime, anywhere.

Conclusion

In an era where digital transformation is reshaping every industry, applying virtual reality (VR) and augmented reality (AR) technologies in the financial and banking sector is not just a trend — it is an essential strategic move. Virtual reality opens up a new dimension of customer engagement, enhances operational efficiency, and builds a stronger, more credible brand image.

At VR360, we are proud to accompany leading financial institutions on their journey of digital transformation, delivering world-class VR solutions that are intuitive, interactive, and impactful. We are committed to helping organizations not only enhance their competitiveness but also pioneer new experiences for their customers.

CONTACT US

Facebook: facebook.com/vr360vnvirtualtour/

Linkedin: linkedin.com/company/vr360dtsgroup/

Email: infor@vr360.com.vn

Address: 123 Pham Huy Thong Street, Nai Hien Dong Ward, Son Tra District, Da Nang City, Vietnam

Table of content

Latest News

VR360 | Thông báo lịch nghỉ lễ 30/04 & 01/05

26/04/2025

26/04/2025 Triển lãm Đà Nẵng - Phát Triển và Hội Nhập: Chặng đường 50 năm

28/03/2025

28/03/2025 VR360 và AIAIVN ký kết MOU, thúc đẩy các giải pháp tích hợp 360, 3D và AI

05/03/2025

05/03/2025 Tăng trải nghiệm với những tính năng nổi bật nên có trong Virtual Tour

05/03/2025

05/03/2025 VR360 | Thông báo lịch nghỉ tết nguyên đán 2025

20/01/2025

20/01/2025 Phòng mô phỏng Roomzify ghi danh trong Top 10 Make in Vietnam 2024

16/01/2025

16/01/2025 Articles on the same topic

VR360 | Thông báo lịch nghỉ lễ 30/04 & 01/05

26/04/2025

26/04/2025 Triển lãm Đà Nẵng - Phát Triển và Hội Nhập: Chặng đường 50 năm

28/03/2025

28/03/2025 VR360 và AIAIVN ký kết MOU, thúc đẩy các giải pháp tích hợp 360, 3D và AI

05/03/2025

05/03/2025 Tăng trải nghiệm với những tính năng nổi bật nên có trong Virtual Tour

05/03/2025

05/03/2025 VR360 | Thông báo lịch nghỉ tết nguyên đán 2025

20/01/2025

20/01/2025 Phòng mô phỏng Roomzify ghi danh trong Top 10 Make in Vietnam 2024

16/01/2025

16/01/2025 Mời tham dự hội thảo Công nghệ thực tế ảo VR360 ứng dụng chuyển đổi số dành cho dịch vụ công

31/10/2024

31/10/2024 Hội thảo Quốc gia về Chính phủ số tại Đà Nẵng

28/10/2024

28/10/2024 VR360 đạt giải Ba chung kết cuộc thi khởi nghiệp SURF 2024

13/09/2024

13/09/2024 Bộ giải pháp tương tác thông minh 3D/360 từ VR360

06/08/2024

06/08/2024